If you’re an individual business owner—whether working as a landlord, consultant, subcontractor, locum, or managing investments—our VAT health check can give you peace of mind by ensuring your VAT setup complies fully with HMRC guidelines.

We’ll also review your circumstances to recommend the most suitable VAT scheme, helping you stay compliant while maximising your financial efficiency. Our straightforward advice makes VAT easier to manage, so you can focus on growing your business.

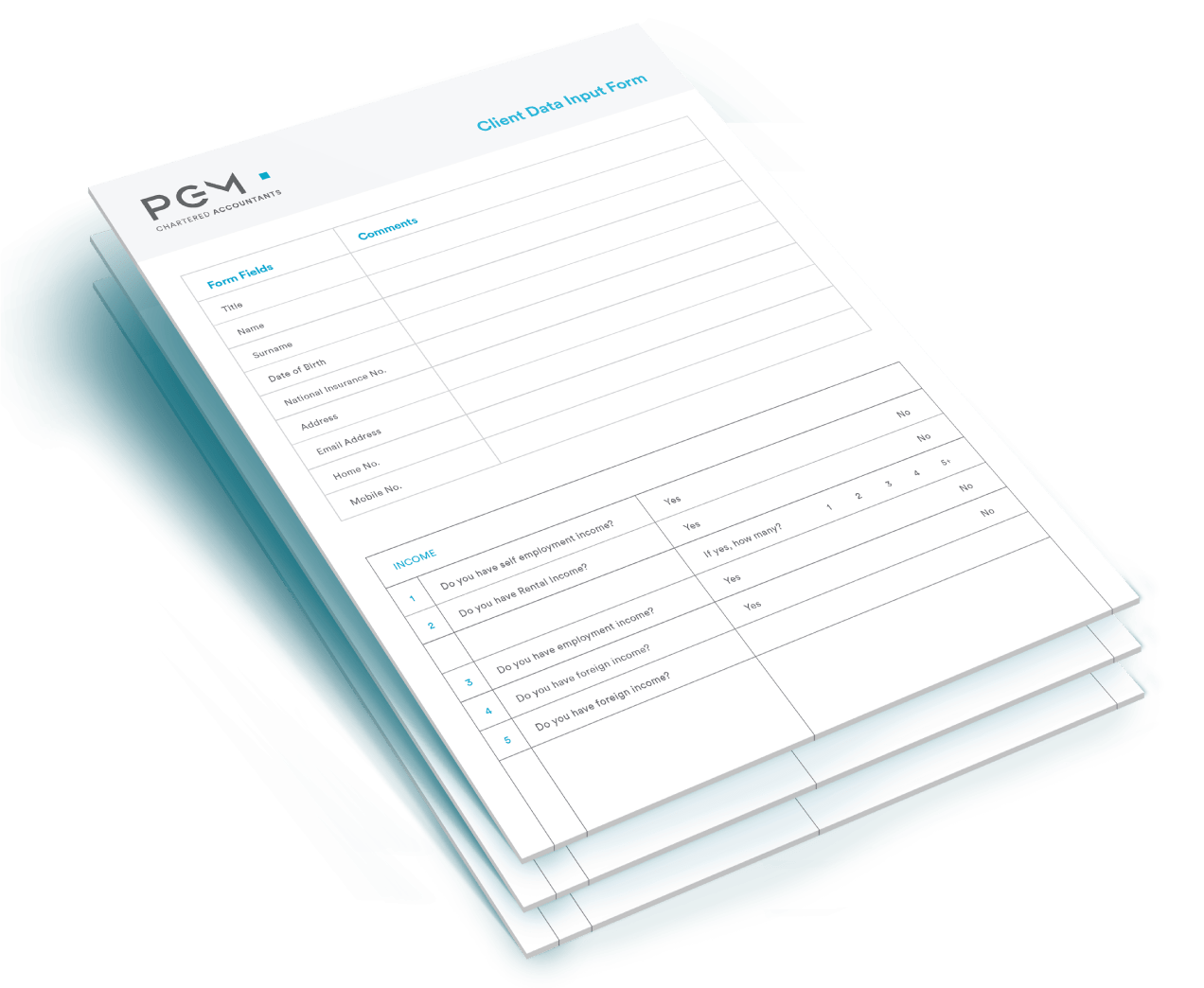

We’re here to help you navigate the completion of your tax return and basic accounts with ease. To make things even simpler, we encourage you to use our cloud accounting and online tax return services, designed to keep your records organised and hassle-free.

Our tax consultancy is tailored specifically to your personal situation. With our expert team by your side, we’ll work to minimise your tax burden, protect your assets, and uncover opportunities to strengthen your financial future.

With HMRC rules constantly evolving, completing self-assessment tax returns can feel overwhelming — but with PGM, it doesn’t have to be. Our experienced team knows personal and business tax inside out, navigating the complexities for you and taking the stress off your shoulders.

If you’d like to learn more, drop by our Belfast or Lurgan office to speak with one of our friendly tax managers. Or, if you prefer, you can get started right away with our convenient online tax return service.

Submitting your tax return couldn’t be simpler with PGM. Our no‑nonsense approach to online tax returns is designed to make your life easier and take the stress out of filing a tax return.

Fill out our registration form and receive a quote within two working days.

We will set up your secure client portal.

Fast and effective submission.

Our proactive tax service is designed to help you make the most of every opportunity available. We provide bespoke tax-saving advice tailored to your unique business circumstances, helping you keep more of what you earn.

When it comes to your personal finances, expert guidance is key to making your money work harder. From succession planning to maximising existing tax reliefs, we’ll help you unlock your full financial potential. Whether you’re starting out, planning for the future, or considering mergers and acquisitions, we’re here to understand your goals and create tailored solutions that help you achieve them — efficiently and tax-smart.

Deciding whether to sell an asset can have significant tax implications. If you’re unsure about moving forward, we’re here to guide you through the best options, helping you minimise tax liabilities and avoid any unexpected bills along the way.

As a subcontractor, it’s crucial your tax is correctly assessed and deducted, so you only pay what you owe. We handle the entire tax return process for you, making sure all previously deducted tax is properly accounted for—giving you peace of mind and more time to focus on your work.

If you’re concerned about the tax burden your family could face when you pass away, we’re here to help. We’ll review your financial situation and explore strategies to minimise the impact of inheritance tax on your estate, helping to protect what matters most for your loved ones.

Couples with differing annual incomes could unlock significant savings through a simple tax review. Our couple’s ‘health check’ assesses your current tax situation and highlights practical ways to reduce your overall tax liability.

Without a careful review of your strategy, you could face unexpected tax charges. With dividend income and interest rules continually evolving, our expertise helps ensure you receive funds from your company in the most tax-efficient way possible. If improvements are needed, we’ll guide you on how to make them.

Whether you’ve recently arrived in the UK or are planning to leave, there are tax rules that could affect you based on your situation. If you’re a UK resident but domiciled outside the UK, recent changes may impact you without you even realizing it. We’ll review your circumstances to assess how these rules might affect you and your family, helping you navigate any potential challenges.

Stepping down from the family business and passing the reins to the next generation can bring significant tax challenges. We offer expert guidance to help make this transition as smooth and tax-efficient as possible, ensuring your family legacy is preserved without unnecessary financial burdens.

If you’re considering buying, selling, or renting a second property, it’s essential to understand the tax implications involved. With several changes in recent years, our team will keep you fully informed of your financial obligations, helping you avoid any unexpected surprises along the way.

Want to find out more about how PGM’s services can help you?

Come and see us for a free 45-minute consultation with one of our qualified chartered accountants. We’ll get to know you, or your business, and explore how our services will be beneficial in providing the financial solutions that you need.