Whether you’re running a limited company or just setting one up, we offer a full range of services designed to simplify your company finances, save you time, and keep everything compliant.

Limited companies face unique tax and accounting challenges, and our specialist team is here to guide you through them. From preparing statutory accounts to providing tailored tax advice and director remuneration strategies, we ensure your company is well positioned for growth and tax efficiency.

For limited companies—and really any business—preparing Year End Accounts can feel overwhelming. There’s always so much to do and never quite enough time.

At PGM, we work alongside you to ease that burden. Our team produces accurate, compliant accounts that reconcile fully with your records. Along the way, we’ll spot any potential tax-saving opportunities early, helping you make the most of your finances.

You must meet two of the following three criteria two years in a row to be considered exempt from a statutory audit.

An annual turnover of no more than £10.2 million

Gross assets worth no more than £5.1 million

50 or fewer employees on average

The above thresholds are rising for accounting periods starting on or after 6th April 2025 to

An annual turnover of no more than £15 million

Gross assets worth no more than £7.5 million

50 or fewer employees on average

With over 50 years of combined experience, our team understands the unique challenges and strengths of limited companies. We deliver comprehensive external audits that not only ensure compliance but also help support your company’s long-term stability and growth.

Whether you operate in:

retail

construction

manufacturing

financial services

technology

or care

we bring industry insight alongside a personalised approach that aligns with your business values and goals.

Easy access to sources of finance – such as bank loans

Additional assurance to potential investors or buyers of your company

Provide assurance that your financial statements are accurately stated

Benefit from more informed decision making

Receive detailed management letters outlining internal weaknesses and recommendations for improvement

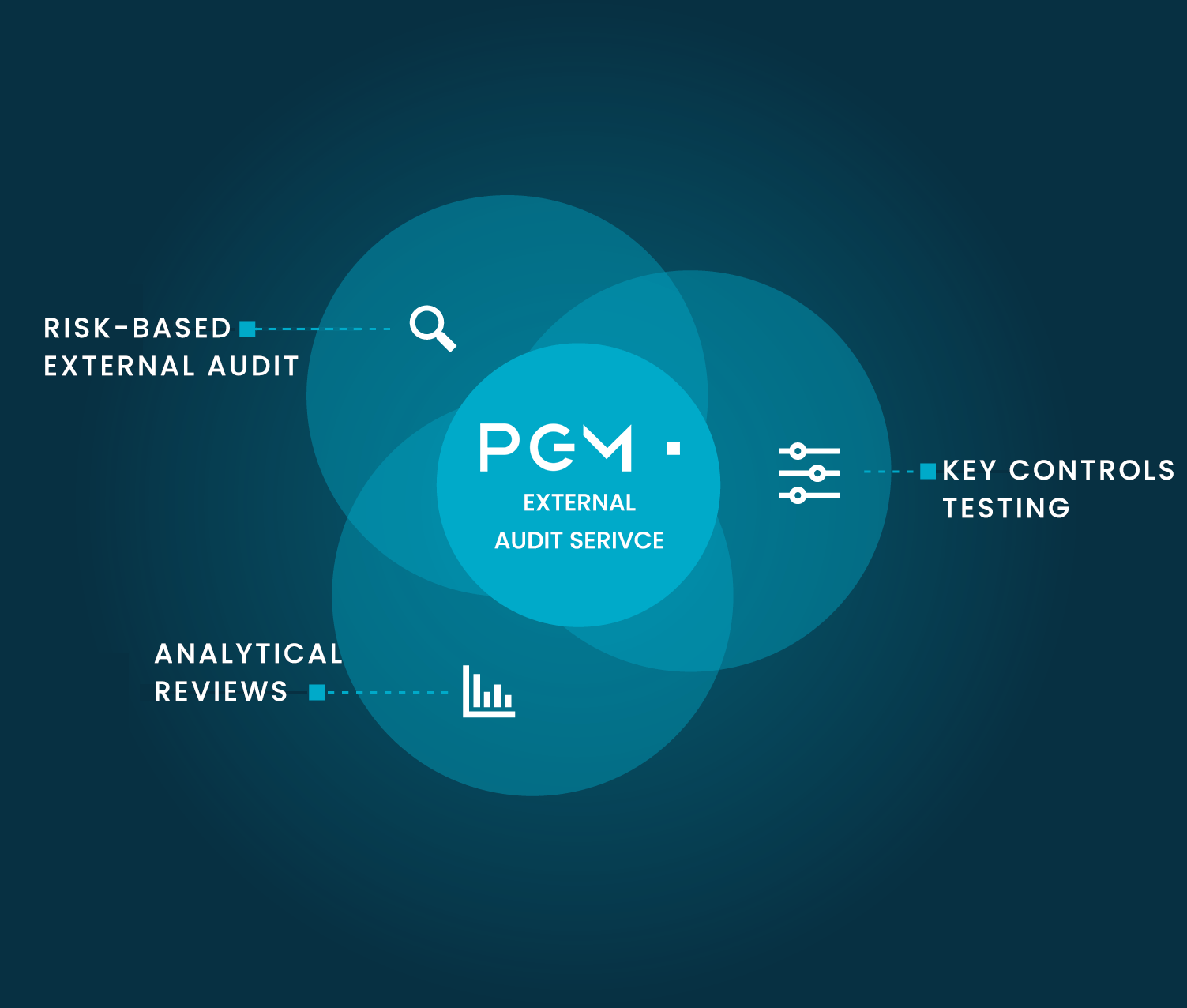

Our approach is divided into three key areas to provide transparency from planning through to reporting.

Our Audit Response System enables us to focus on the processes and requirements most relevant to your company.

We’ll provide a clear quote upfront for our external audit services — so you know exactly what to expect, with no hidden fees. Once you’re happy to proceed, we’ll send over an engagement letter for your approval before getting started.

We’ll work closely with your management team to fully understand your business. By identifying the key audit risks, we create a tailored audit plan focused on reducing those risks. Then, we’ll meet with your team to agree on the audit’s scope and timeline, ensuring a smooth and clear process from start to finish.

Most of the audit fieldwork happens on-site, where we’ll meet your team and review important procedures and controls. We keep communication open throughout, regularly updating management on progress and any potential issues. Once the work is complete, two members of our internal management team will carefully review everything to ensure quality and accuracy.

After the audit, we’ll provide an audit report and management letter that highlight any internal control weaknesses we’ve found, along with practical recommendations to help you improve.

The strength of a limited company lies in its foundation — the people, processes, and shared goals that drive its success. Our internal audit service is designed to help you safeguard that foundation and unlock your company’s full potential.

We take a close look at your operations, pinpointing areas where improvements can be made and providing clear, practical recommendations to support your company’s long-term growth and stability.

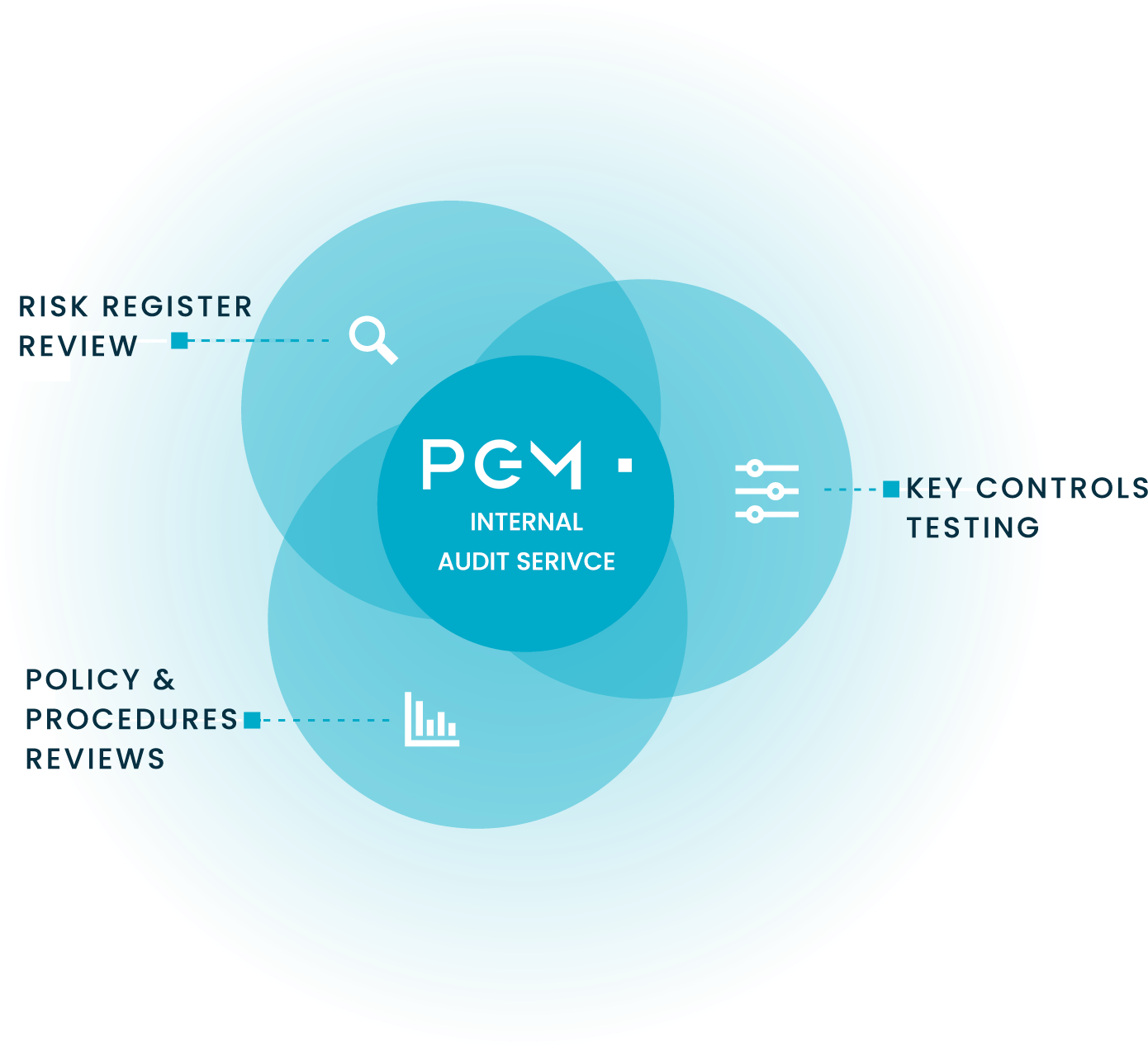

Our approach is divided into three key areas to provide transparency from planning through to reporting.

Our Audit Response System enables us to focus on the processes and requirements most relevant to your company.

Our detailed reports highlight key areas where your company can improve by pinpointing potential risks early on.

Using a straightforward traffic light system, we help you quickly prioritise concerns and understand the findings at a glance. Any issues marked amber or red come with clear recommendations on how to reduce the risks and strengthen your business.

HMRC rules are always evolving, which can make preparing tax returns for your limited company feel overwhelming — but with PGM, it doesn’t have to be. Our experienced team specialises in corporate tax and company returns, navigating the complexities on your behalf to ensure compliance and ease your workload.

If you’d like to find out more, pop into our Belfast or Lurgan office to speak with one of our expert tax managers. Alternatively, you can take advantage of our easy-to-use online tax return service to get started today.

Our proactive tax service is designed to help limited companies like yours make the most of every available opportunity. We provide tailored tax-saving advice that fits your specific business needs. From strategic business planning and financial forecasting to handling EU VAT returns and managing auto enrolment, we offer practical solutions to help your company grow and reach its financial goals.

If you’re looking to minimise your tax burden, review your current strategies, and stay fully compliant with regulations, our expert team is here to guide you every step of the way.

Auto enrolment has transformed pension responsibilities for employers across the UK. As a limited company, you’re required to set up a qualifying workplace pension scheme and automatically enrol eligible employees, making regular contributions each pay period. Staying on top of these legal obligations is crucial to avoid costly penalties.

We can manage the entire auto enrolment process for you—from initial setup to ongoing compliance—taking the hassle off your plate and ensuring your company stays fully compliant with the latest regulations.

We take the time to fully understand your business and its future goals before offering any advice. This allows us to assess your company’s unique needs and help you select the most tax-efficient structure to support your growth.

Choosing the right structure is key to steering your business forward smoothly. Our team will guide you through this process, providing expert advice to help you avoid potential tax pitfalls down the line.

No matter the size of your business, we’re here to support all your planning and forecasting needs. Whether you’re a start-up ready to launch your idea or an established company aiming to reach the next stage, we offer practical, tailored advice aligned with your long-term goals.

By taking the time to truly understand your business, we’ll work closely with you to craft bespoke business plans that set a clear path for growth and success.

Your business might be leaving valuable savings on the table through capital allowance entitlements. Whether you’re investing in machinery, vehicles, technology, or other substantial assets, there’s a strong possibility you can claim significant relief.

Our team will review your asset expenditures carefully and guide you on the best strategies to maximise your claims—helping to improve your cash flow and support your business growth.

Thinking about selling an asset? It’s important to keep tax liabilities to a minimum. If you’re unsure whether now’s the right time to sell, we’re here to guide you through your options — making sure there are no unexpected tax surprises along the way.

If you work with subcontractors, you’ll know how demanding the monthly CIS returns to HMRC can be. Let us handle the processing and submission for you, freeing up your time to focus on running and growing your business without the stress of paperwork.

As a subcontractor, making sure your tax is accurately calculated and fairly deducted is essential. At PGM, we’ll take care of the entire tax return process for you — making sure any tax already deducted is properly accounted for and helping you avoid overpayments.

Rewarding your staff reaps great benefits for both you and your employees alike. By ensuring this is carried out through the most tax efficient method, we can help you take steps that will enable you to reward staff without incurring excessive costs.

Rewarding your team can boost morale, loyalty, and performance — but it’s important to do so in a tax-efficient way. At PGM, we help you explore cost-effective reward strategies that benefit your employees while keeping your business financially smart and compliant.

Planning for the future means protecting what matters most. If you're concerned about the tax implications your family could face when you pass away, we’re here to help. At PGM, we’ll work with you to review your financial position and explore options that can reduce the impact of inheritance tax — giving you peace of mind that your estate will be passed on as smoothly and tax-efficiently as possible.

HMRC PAYE inspections can be stressful — but they don’t have to be. Our PAYE & NIC health check gives you clarity and confidence by reviewing your current setup in detail. From Payroll and Benefits to Expenses, P11D forms and National Insurance Contributions, we’ll assess each area to ensure everything is accurate, compliant, and ready for scrutiny.

Without regular review, your company’s remuneration strategy could be exposing you to unnecessary tax. With legislation around dividend income and interest constantly evolving, it’s essential to ensure your approach remains efficient and compliant.

We’ll assess how you're currently extracting income from your business, highlight opportunities for improvement, and offer tailored advice to help you maximise tax efficiency — now and into the future.

Stepping away from your company and passing control to the next generation can raise complex tax considerations — but it doesn’t have to be overwhelming. At PGM, we take the time to understand your goals and work with you to create a transition plan that’s structured, strategic, and as tax efficient as possible.

Whether you’re preparing for retirement or simply stepping back from day-to-day operations, we’ll help ensure the handover protects both your legacy and the long-term future of the business.

VAT can be complex — but staying on top of it doesn’t have to be. At PGM, we offer a thorough VAT health check to make sure your business is fully compliant with HMRC guidelines and that everything is running as it should be.

We’ll also take a closer look at your current VAT scheme and assess whether it’s the most suitable and tax-efficient option for your company. If there’s a better fit, we’ll guide you through the switch, helping you stay compliant while keeping your cash flow in check.

Want to find out more about how PGM’s services can help you?

Come and see us for a free 45-minute consultation with one of our qualified chartered accountants. We’ll get to know you, or your business, and explore how our services will be beneficial in providing the financial solutions that you need.